Tips, Safety & FAQ

Tips for Successful Trading

Setting Realistic Prices

- Check Current Price: Always look at current market price before setting your limit.

- Analyze Recent Ranges: Review price history to set achievable targets.

- Don’t Get Too Greedy: Extremely optimistic prices may never execute.

Managing Slippage

- Set Appropriate Tolerance: Leave 0.5-2% buffer for fees and price movement.

- Account for Order Size: Larger orders need more slippage tolerance.

- Consider Volatility: More volatile pairs need wider slippage settings.

Choosing Deadlines

- Short-term (Hours): For time-sensitive trades or highly volatile markets.

- Medium-term (Days): For normal market conditions with reasonable price targets.

- Long-term (Weeks): For patient accumulation or ambitious exit targets.

Safety & Security

How Your Funds Are Protected

- Smart Contract Escrow: Your tokens are held in a secure, audited smart contract until execution.

- No Counterparty Risk: Trades execute directly on-chain through DEX liquidity pools.

- You Stay in Control: Cancel anytime before execution to reclaim your tokens.

- Automatic Return: Expired orders automatically return unfilled tokens to you.

- Reentrancy Protection: Built-in safeguards prevent common attack vectors.

Token Whitelisting

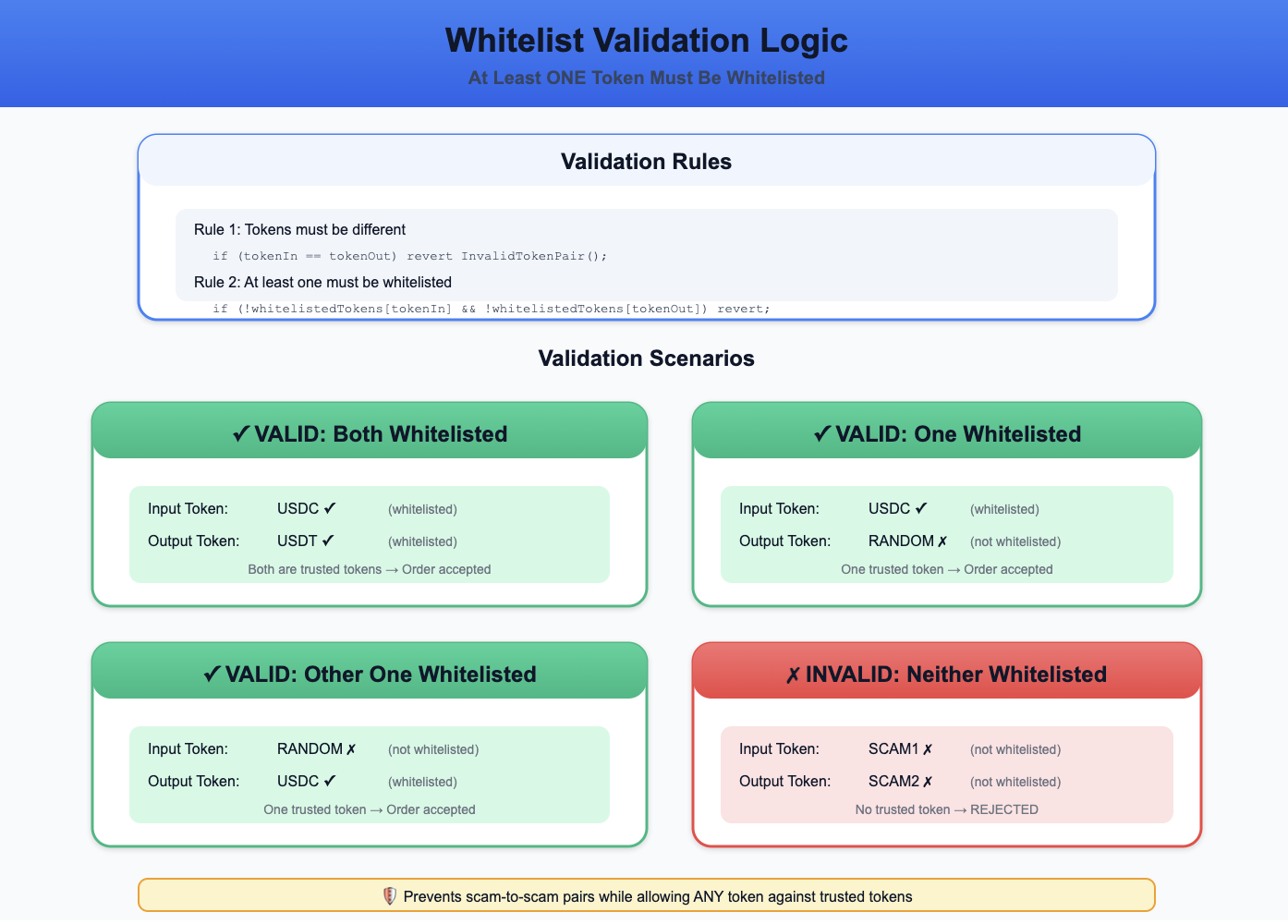

Not all tokens can be traded on EMPX. The platform maintains a whitelist of verified tokens to protect users:

- For SELL Orders: The output token (what you receive) must be whitelisted.

- For BUY Orders: The input token (what you deposit) must be whitelisted. This prevents trading of malicious or scam tokens.

Emergency Pause

In case of critical issues, the platform can be temporarily paused. Order creation and execution stops, but Cancellation remains available so you can always withdraw your funds.

Frequently Asked Questions

Q: What happens if my order never reaches my target price? A: If your order doesn’t execute before the deadline, it automatically expires and your tokens are returned to your wallet. You can then cancel or recreate the order with a different price.

Q: Can I change my order after creating it? A: No, orders cannot be modified once created. To change your order, cancel it and create a new one.

Q: What if I cancel a partially filled order? A: You’ll receive back only the unfilled portion of your input token. The filled portion has already been converted to your output token and sent to your wallet.

Q: How do I know when my order executes? A: Check your order status in the interface, or monitor your wallet for incoming tokens.

Q: Why didn’t my order execute even though price reached my limit? A: This can happen due to: (1) Insufficient liquidity, (2) Slippage tolerance too tight, (3) Gas prices too high for profitable bot execution, or (4) Price only briefly touched your limit.

Q: Are there any risks? A: Main risks include: price volatility causing slippage, execution at slightly worse than limit price due to fees, and smart contract risk (minimized through audits).

Q: Can I use this for any token pair? A: No, at least one token in the pair must be whitelisted.

Q: What’s the minimum order size? A: No strict minimum, but orders under $100 may not be cost-effective due to gas fees.

Q: Can I have multiple orders active at once? A: Yes! You can create as many independent orders as you want.